Jungheinrich confirms forecast for 2017

| Company | Jungheinrich AG |

|---|---|

| Date | 07.11.2017 |

- Net sales +13 per cent, value of incoming orders +8 per cent and units +12 per cent

- Orders on hand at the end of September +16 per cent (against end of 2016)

- Growth driver: demand in Europe

In the first nine months of 2017, Jungheinrich continued to grow consistently: key performance figures increased year-on-year, signalling another successful financial year. This development was primarily driven by high demand in Europe, Jungheinrich’s core market.

Dr Volker Hues, CFO of Jungheinrich AG: “We continued to operate successfully in the third quarter, building on the momentum of the first of half of the year. We are therefore well within the increased forecast range published in the summer. We especially benefited from solid business in our European core market and pleasing market demand in the logistics systems business.”

Development January – September 2017

The global market for material handling equipment recorded strong growth of 17 per cent between January and September 2017. The driving force behind the significant year-on-year increase in market volume was demand from the Chinese market, which climbed by 41 per cent. Demand in Europe rose by 11 per cent, with Western Europe up by 9 per cent and Eastern Europe up by 23 per cent, thanks to Russia.

Global demand in the warehousing equipment product segment increased by 15 per cent, which represents almost 58 thousand forklifts. Approximately half could be attributed to Asia, primarily China, followed by Europe. This region was responsible for 38 per cent of the increase. The 13 per cent increase in global market volume of battery-powered counterbalanced trucks was driven by greater demand from Europe (+16 per cent) and considerably more new orders from China (+31 per cent). Approximately 70 per cent of the enormous increase of 21 per cent in global demand for IC engine-powered trucks was due to significantly higher orders from China.

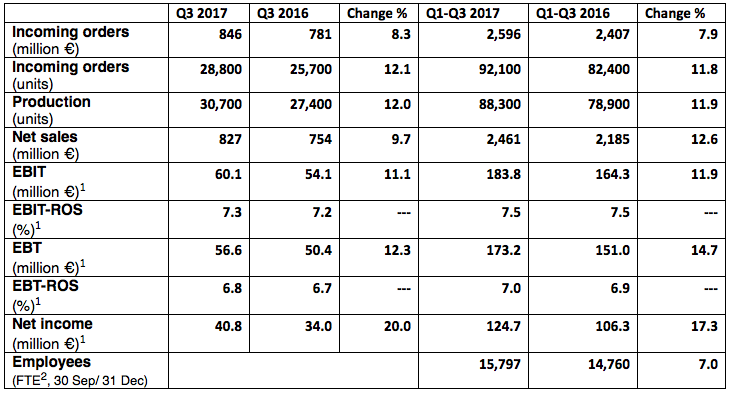

After the first nine months, incoming orders in the new truck business, which include orders for both new forklifts and trucks for short-term hire, totalled 92.1 thousand trucks, up 12 per cent on the corresponding figure in the previous year (82.4 thousand trucks). At €2,596 million (previous year: €2,407 million), the value of incoming orders in the reporting period, which includes all business fields – new truck business, short-term hire, used equipment and after-sales services – increased by 8 per cent year-on-year. Almost a quarter of this upswing is attributable to higher demand for logistics system solutions. Orders on hand for new truck business came to €709 million as of 30 September 2017, which is €20 million or 3 per cent higher than the previous year (€689 million). Compared with orders on hand of €610 million as of year-end 2016, it represents an increase of €99 million or 16 per cent. Orders therefore account for more than four months of production.

The Jungheinrich Group ended the first nine months of 2017 with earnings before interest and taxes (EBIT) of €183.8 million (previous year: €164.3 million1). This improvement was primarily driven by the 12 per cent increase in units produced (88.3 thousand units; previous year: 78.9 thousand units). The EBIT return on sales (EBIT ROS) was on a par with the same period of the previous year at 7.5 per cent1. Earnings before taxes (EBT) rose to €173.2 million at the end of the first nine months (previous year: €151.0 million1). EBT return on sales (EBT ROS) came to 7.0 per cent (previous year: 6.9 per cent1).

Jungheinrich Group at a glance

|

|---|

| 1) Comparative figures for 2016 have been adjusted in line with IFRS 3 due to the classification and valuation of customer leases as part of the final purchase price allocation for NTP Forklifts Australia (NTP), acquired in November 2015. 2) FTE = Full-time equivalents |

Further information and details on market performance and business growth in the first nine months of 2017 can be found in the interim statement (pursuant to Section 51a of the Frankfurt Stock Exchange Regulations).