Airport Towing Trucks For Material Handling

| Company | Jungheinrich AG |

|---|---|

| Date | 06.11.2013 |

|

PI_27_2013_WP_en_Zwibi.pdf Size : 562.612 Kb Type : pdf |

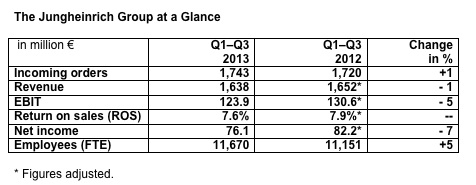

Hamburg—In the third quarter of 2013, the Jungheinrich Group recorded a slight increase in net sales, which cumulatively were nearly on par year on year after nine months. The value of incoming orders from January to September 2013 was 1 per cent higher than in the same period last year. Orders on hand were 37 per cent up on the end of December 2012. For the fiscal year underway, the Board of Management confirms its forecast for net sales and incoming orders and expects EBIT to total between 165 and 170 million euros.

While the global economy displayed moderate development, the world material handling equipment market expanded by 5 per cent in the first nine months of 2013, encompassing 752.0 thousand forklift trucks compared to 716.3 thousand units in last year's corresponding period. However, demand in Europe, Jungheinrich's core market, was 1 per cent lower year on year. Western Europe recorded a drop of 3 per cent, whereas Eastern Europe's market volume grew by 6 per cent. The Asian market was enlarged considerably, expanding by 8 per cent, to which China contributed a gain of 12 per cent. The North American market continued to post strong growth, recording an increase of 11 per cent.

In the first nine months of the current financial year, the value of the Jungheinrich Group's incoming orders encompassing all business fields amounted to 1,743 million euros, slightly surpassing the 1,720 million euros achieved a year earlier. At 574 million euros, incoming orders in the third quarter of 2013 were 1 per cent down on the figure recorded in the same period last year (580 million euros) which included a major order in the logistics systems business. Orders on hand in new truck business totalled 407 million euros as of September 30, 2013, rising by 109 million euros, or 37 per cent, over the figure on the books at the end of 2012. The range of orders remained in excess of four months.

Due to amendments to IFRS accounting policies and changes in disclosure to increase transparency in reporting from January 1, 2013 onwards, Jungheinrich adjusted the comparable figures for fiscal 2012. On a like-for-like basis, net sales in the third quarter of 2013 amounted to 560 million euros—marginally up on the figure achieved in the same quarter last year (557 million euros). Cumulatively, consolidated net sales totalled 1,638 million euros in the first nine months of 2013, nearly matching the prior-year level (1,652 million euros). Net sales from January to September 2013 were down 2 per cent to 434 million euros (prior year: 442 million euros). Foreign net sales fell by just under 1 per cent to 1,204 million euros (prior year: 1,210 million euros).

The pillars of the Group's net sales trend, which was essentially flat, were gains recorded by short-term hire and used equipment business as well as in after-sales services, which nearly fully offset the reduction in net sales experienced in new truck business. In the first nine months of 2013, the Jungheinrich Group generated 846 million euros from new truck business (prior year: 881 million euros). Net sales achieved with trucks for short-term hire and used equipment were increased by a combined 5 per cent to 290 million euros (prior year: 277 million euros). After-sales services contributed net sales which were up a good 3 per cent to 517 million euros (prior year: 500 million euros).

The Jungheinrich Group closed the third quarter of 2013 with earnings before interest and taxes (EBIT) of 41.8 million euros (prior year: 45.1 million euros). The decline is due to the delayed start of production at the new warehousing and system equipment plant in Degernpoint. September saw the first forklift trucks rolling off the manufacturing line, albeit fewer than planned owing to delays for process-related reasons. Cumulatively, EBIT from January to September 2013 totalled 123.9 million euros (prior year: 130.6 million euros). After nine months, the corresponding return on sales was 7.6 per cent (prior year: 7.9 per cent). Net income amounted to 26.8 million euros in the third quarter of 2013 (prior year: 28.1 million euros) and totalled a cumulative 76.1 million euros in the first nine months of 2013 (prior year: 82.2 million euros). Accordingly, earnings per preferred share amounted to 2.27 euros in the nine-month period of 2013 (prior year: 2.45 euros).

The Jungheinrich Group's balance sheet total decreased by 61 million euros, amounting to 2,698 million euros as of June 30, 2013 (December 31, 2012: 2,759 million euros). The equity ratio rose further, to 29.2 per cent (December 31, 2012: 27.3 per cent). Intangible and tangible assets were up 46 million euros to 400 million euros. The first-time consolidation of the logistics software firm ISA – Innovative Systemlösungen für die Automation GmbH and the strategic capex projects for increasing capacity came to bear here.

As regards the continued development of business, Jungheinrich still expects the global economy to post moderate growth until the end of the year. Against this backdrop, the company anticipates that the worldwide material handling equipment market will record solid growth for 2013 as a whole. However, the European market may well remain slightly smaller than last year. Jungheinrich prognosticates that Asia will post a significant rise in market volume for the full year, driven above all by the strong recovery of the Chinese market. The North American market should continue to expand significantly.

Based on the economic forecasts, the expected developments on the global material handling equipment market and the positive trend displayed by incoming orders year to date, Jungheinrich confirms its forecast for incoming orders and net sales, expecting figures for fiscal 2013 in the order of last year's level. As regards EBIT, the Board of Management has set its assessment at a figure between 165 and 170 million euros.

Jungheinrich expects the worldwide economic environment to improve in 2014. Against this backdrop, the global material handling equipment market should continue to grow next year, albeit displaying regional differences. Says Hans-Georg Frey, Chairman of the Board of Management of Jungheinrich AG: "By successfully completing the strategic investment projects, we have established the prerequisites for benefiting from the market's positive development expected in 2014 and subsequent years."

Jungheinrich ranks among the world’s leading companies in the material handling equipment, warehousing and material flow engineering sectors. The company is an intralogistics service and solution provider with manufacturing operations, which offers its customers a comprehensive range of forklift trucks, shelving systems, services and advice. Jungheinrich shares are traded on all German stock exchanges.

Please address press-related inquiries to:

Jungheinrich AG; Markus Piazza, Head of Corporate Communications

Phone: +49-40-6948-1550, Fax: +49-40-6948-1599, markus.piazza@jungheinrich.de

www.jungheinrich.com