How will we fly beyond the crisis? Read the present, understand the future with Denise Farese

| Company | One Works |

|---|---|

| Date | 28.12.2020 |

The following is an extract from the first issue of DomusAir. The new magazine created by Domus and One Works that focuses on the key topics of aviation, mobility and transport infrastructures, new technologies and sustainability.

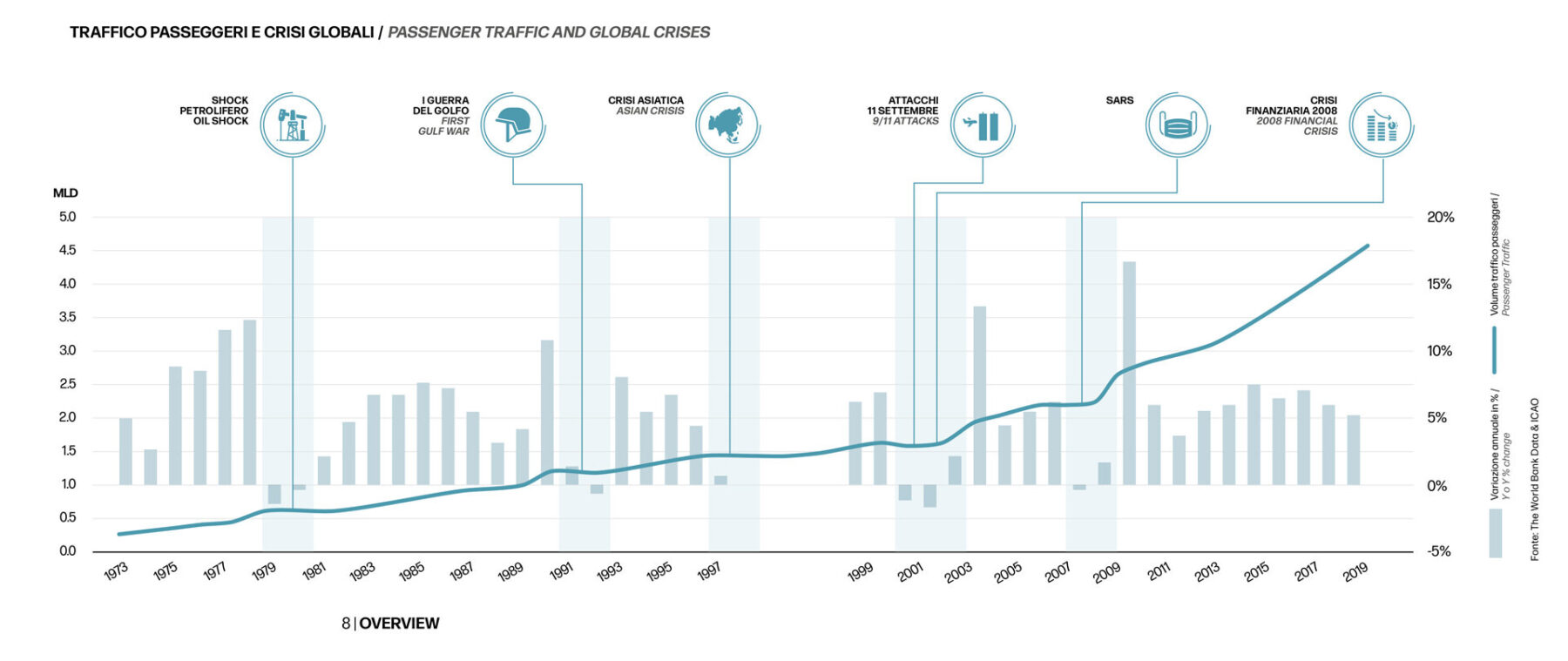

The reduction in air traffic or complete cancellation of many routes we are witnessing today are not the consequence of ordinary business cycles. History teaches us that one of the particular features of the aviation industry is resilience.

After the crisis of 11 September 2001, which caused air passenger traffic to fall off by approximately 30%, it took some three years to return to pre-crisis levels. After the financial crisis that shook the entire world in 2008, with repercussions on travel, international air traffic had recovered to pre-recession levels less than 18 months after the lowest trough. The eruption of the Eyjafjallajökull volcano in Iceland in April 2010 grounded much of the European fleet for three months. Last year the Boeing 737 Max was grounded after two fatal accidents.

These crises mainly resulted in reduction in demand over a relatively brief timespan and were relatively less severe than what we are witnessing today: the COVID-19 crisis is a wholly novel event in the history of air transport.

PASSENGER TRAFFIC AND GLOBAL CRISES – The infographic highlights the effects of the main global crises from the 1970s on air traffic volumes. Despite the shock phases, traffic development sees an overall positive trend.

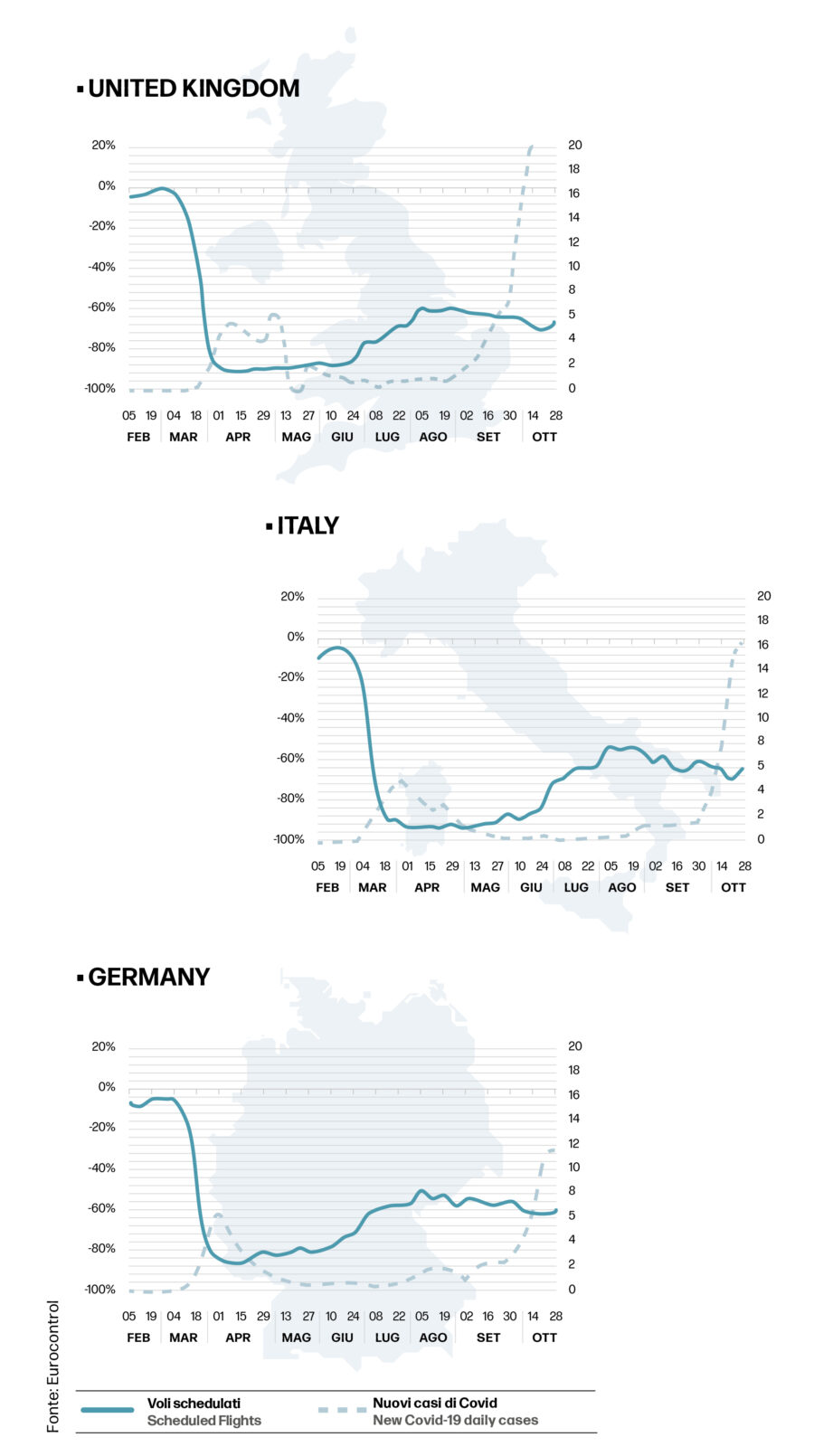

A comparative analysis that relates the progression of infections during phase 1 and phase 2 of Covid, with the trend of passenger air traffic. It can be seen that the curves relating to flights tend to be similar even in three different national contexts, who have lived and faced with different strategies the different phase of the pandemic.

With cases of infection on the rise, air traffic has witnessed devastating dips. The number of regularly scheduled flights fell by roughly 70% globally in the month of May 2020, the height of the crisis, when few non-critical routes were still being flown. In the months of March, April, and May, the total lockdown in Italy virtually halted all local air traffic.

Significant signs of recovery were not seen until summer, although nothing close to the same period in previous years. Air traffic in August reached roughly 50% of what it had been the year before, mainly toward tourism destinations and in regional markets.

Now, with infection on the rise again, and in the absence of uniform policy on the European level, most airline companies are forced to reduce the capacity of their networks also for the coming winter months.

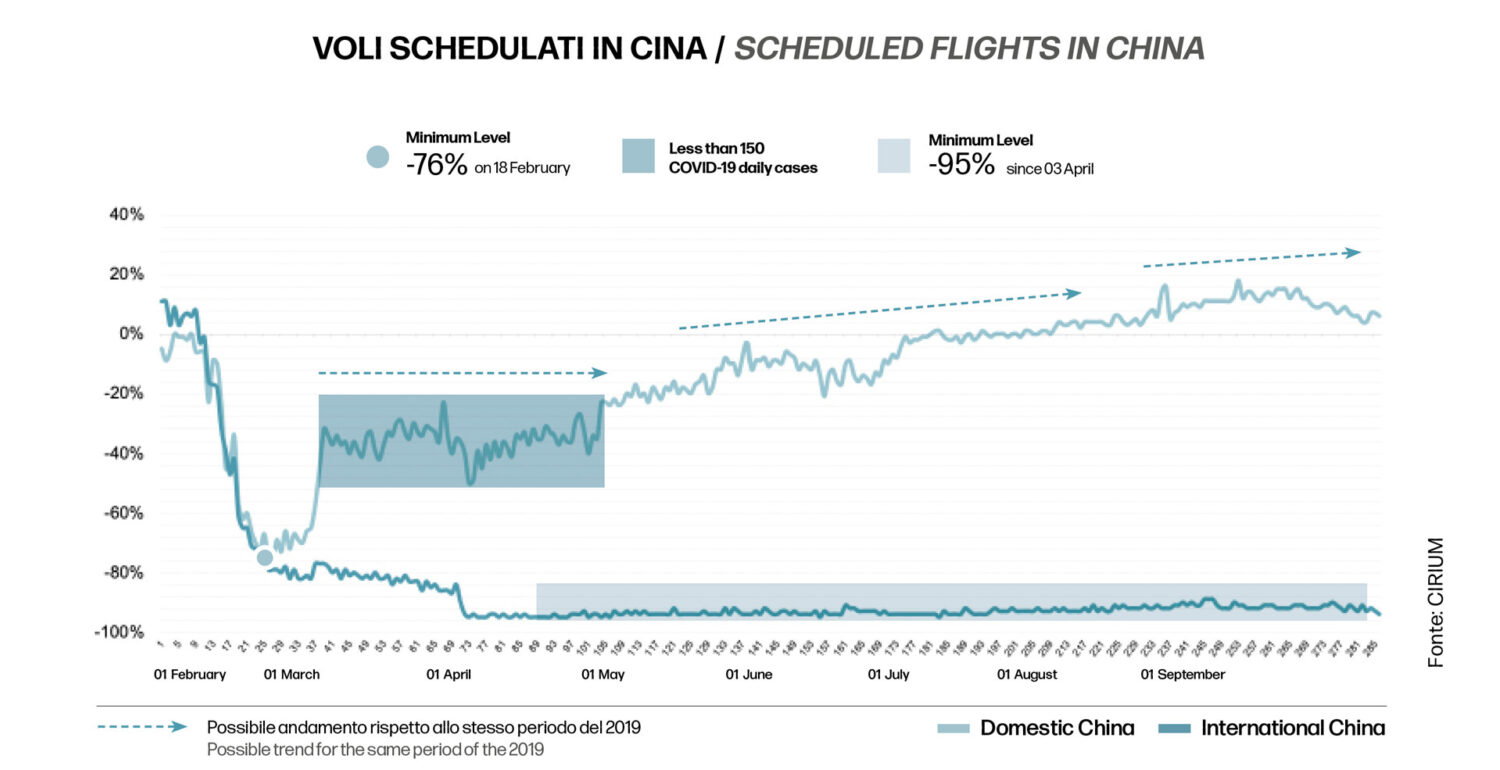

Among the regions affected by the Coronavirus, Asia is farthest ahead in terms of resumption in traffic. With flights exceeding the volume recorded in 2019, China is the first market to recover, having also been the first to shut down, in late January, implementing restrictions similar to those imposed for the SARS epidemic in 2003.

Uncertainties relating to the health crisis and the disjoint, patchwork nature of political and operational decisions around the world have made forecasting and planning—the pillars of air transport management—impracticable, with devastating repercussions on airport infrastructure. The variables on which the analysts base their work have been characterized since the beginning of the crisis by sudden and major variations, also in dependency relations, which in some cases have had to be redefined.

The very-short-term resumption of air traffic hinges on the offer of flights and seats by airline companies, whose planning must now be done with shorter notice than ever before and within a context that changes from week to week. Indeed, there is often a significant discrepancy between scheduled flights and effectively operated flights: the models used by the airlines have changed, now taking into consideration data such as online flight searches and consumer perception, which are constantly changing.

Recovery in medium- and long-term demand is another story. Doubt has been cast on whether the previously consolidated prediction methodologies will be effective in conditions that differ greatly from those under which they were developed. It is essential to devise new approaches capable of combining the information provided by classic econometric models with discretional assessments regarding factors having the greatest effect on the relevant context: the progression, duration, and geographical extent of the pandemic; the socioeconomic forecast framework; changes in modes and preferences of personal mobility; propensities and incentives for flying; and others as well.

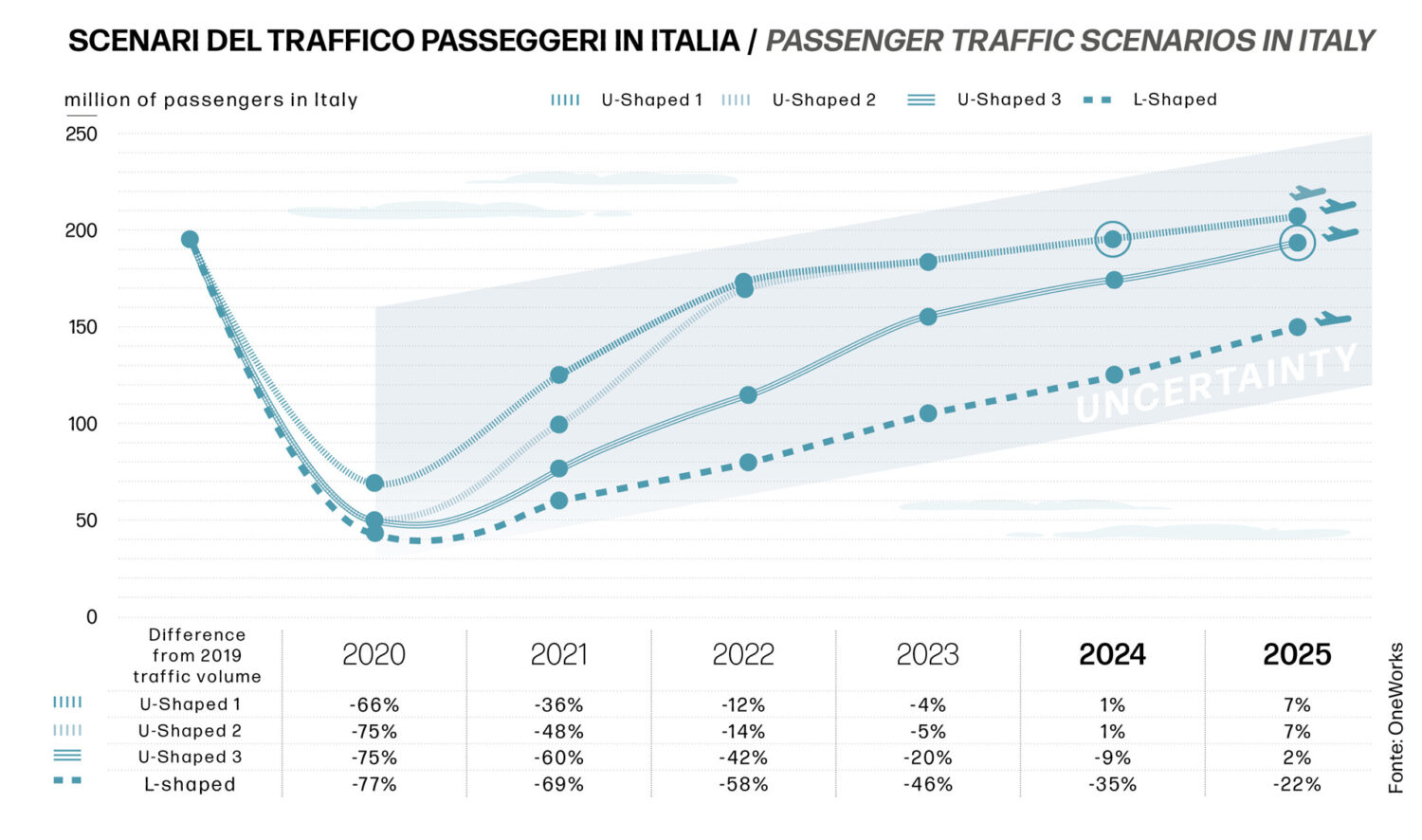

These are all factors that have to be taken into consideration in delineating scenarios of recovery. However, one of the essential keys to ensuring an effective recovery is decisional coordination among countries in cohesive regions such as the European Union in order to forge an exit strategy from the current crisis based on mutually agreed approaches. The broad range of envisioned scenarios points to either U-shaped or V-shaped recovery in air-traffic demand. In the early months of the crisis, analysts sought to boost optimism by citing previous case studies, most of them forecasting a V-shaped recovery with air traffic returning to 2019 levels within roughly two years.

However, the short-term outlook then darkened, indicating a slower, more gradual resumption, i.e., U-shaped. In the most pessimistic scenario, demand for air transport does not necessarily recover to previous volumes for a much longer time. What we are beholding now is indeed more similar to a K-shaped recovery, in which some sectors, such as technology and healthcare services, are growing significantly while others, such as transportation and entertainment, continue to recording significantly sub-performance.

In all the above hypothetical scenarios, the domestic and leisure markets will recover before the international market and business one do. Relatively small countries characterized by a well integrated infrastructural network will suffer more and recover more slowly. And the seasonal nature of air traffic will also play a key role: airports with seasonal traffic may enjoy a more marked recovery in their respective peak periods, thus counterbalancing the overall reduction in volumes. Low cost airlines are better able to adapt to changes in the market and competition will be necessary to ensure faster recovery.

The projection to 2025 assumes 4 types of scenario. Three scenarios characterized by a U-shaped trend, one scenario (if none of the positive conditions of recovery occurs), which foresees an L-shaped trend.

The projection to 2025 assumes 4 types of scenario. Three scenarios characterized by a U-shaped trend, one scenario (if none of the positive conditions of recovery occurs), which foresees an L-shaped trend.

A focus on the impact of the pandemic on Chinese air traffic, with the variations related to the trend of the daily cases detected.

Original article written by Denise Farese and appeared on DomusAir No.1. Denise, One Works Associate Engineer, is highly skilled in techniques of quantitative and statistical data analysis, expert in Traffic Demand Forecasts and Capacity Analysis of airport infrastructures.

Cover photo by Suganth on Unsplash.